what is a provisional tax code

Meaning of unpaid tax and overpaid tax for certain transferees under AIM method Repealed 120M. Date of Birth is required.

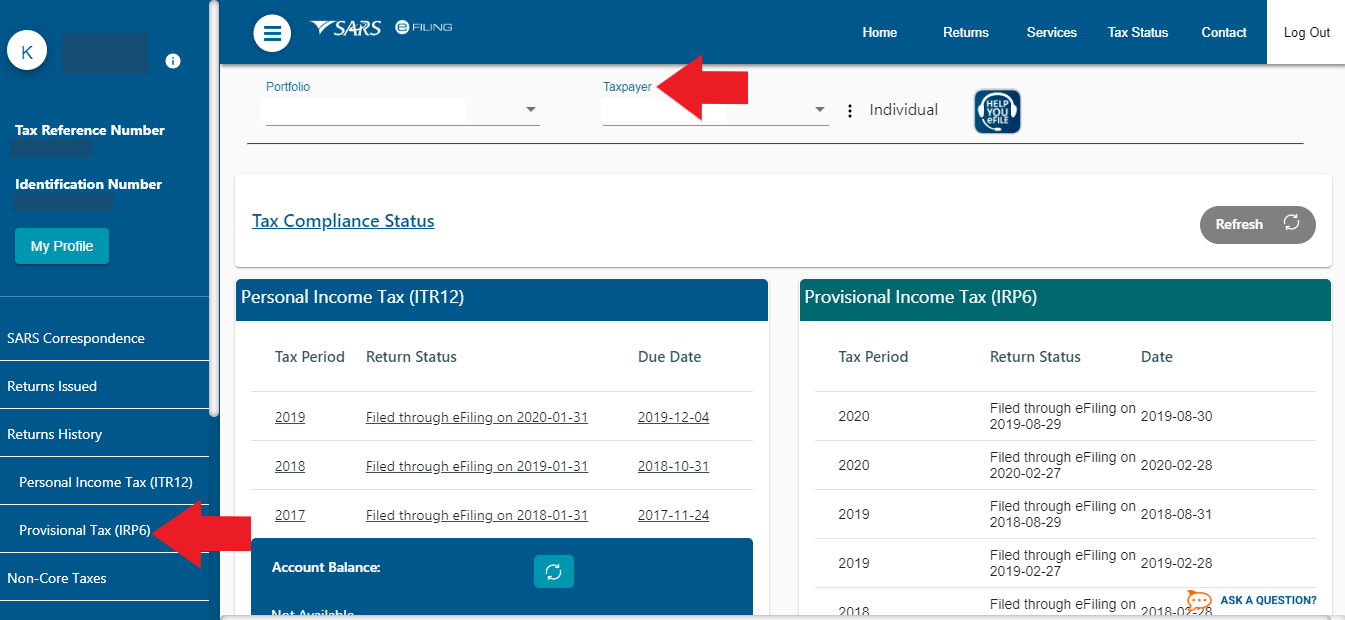

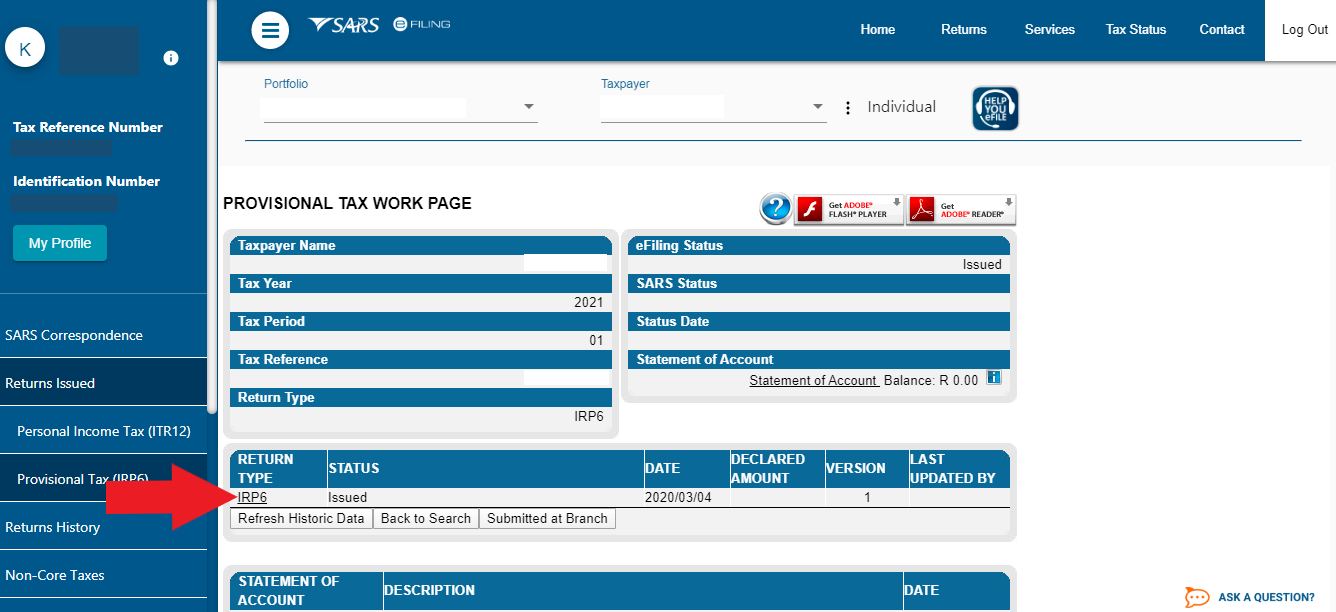

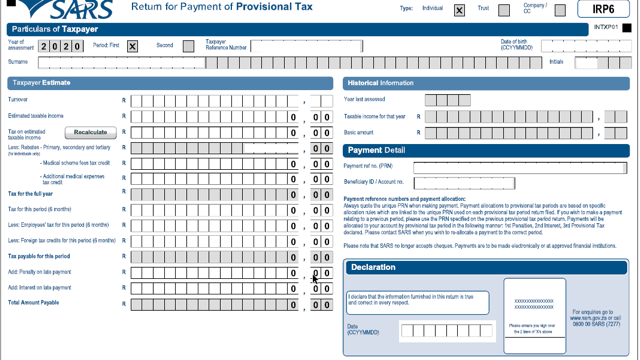

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Tap To Pay.

. A home loan certificate is nothing but a statement of your home loan account provided by your lender. Provisional attachment to protect revenue in certain cases. The provisions of this 15141 adopted May 17 2002 effective May 18 2002 32 PaB.

Provisional income levels are calculated with gross income tax-free interest and half of the recipients Social. The provisional budget approved by the Nanaimo Regional Hospital District board on Dec. Tolerance for provisional tax instalments.

Provisional duty of Rs8197292- estimated was paid as per Bill of Entry No0810-11 dated 03022011 which was finally assessed on the same estimated duty on 11102011. Provisional tax payments are due if you have a March balance date and use the ratio option. Provisional income is a tool used by.

The base for provisional income is from 86 of the Internal Revenue Code. This article provides complete details about the change how this change affects businesses and how businesses can be prepared with Clears. Provisional Balance Sheet is an un-audited balance sheet.

You pay it in instalments during the year instead of a lump sum at the end of the year. Vide letter dated 03022011 the appellant claimed benefit of preferential rate of Customs Basic Duty duty at the rate of 3 ADV under Notification No1532009 Customs dated 31122009 as. View All Options iMOBILE PAY.

Use NFC-enabled tag linked with prepaid account to tap and pay at merchant outlets. In 2021 SARS introduced a Covid-19 Tax Relief for Provisional Tax aimed at compliant small to medium-sized businesses and micro-businesses. We need to check availability of service in your area City.

4 Local tax records. Please try again later. Enter a valid Email Address.

2581 Short-Term Approval for Career and Technical Education. Make your GST payments through our branch or with. Learn more about Income Tax Income Tax Slabs e-Filing Income Tax Income Tax Refund and Income Tax Return.

It is the summary of the interest and the principal amount repaid by you towards your Home Loan for the given financial year and serves as a proof of home loan repayment. It is prepared on the basis of Past data ie. 11 Where after the initiation of any proceeding under Chapter XII Chapter XIV or Chapter XV the Commissioner is of the opinion that for the purpose of protecting the interest of the Government revenue it is necessary so to do he may by order in writing attach provisionally any property including.

To apply you must. This means that the LOWER of provisional ITC or difference in eligible ITC between books and GSTR-2B had to be considered. Use Scan to Pay to generate QR code scan using any UPI app and make the payment.

Discover the latest driving laws news rule changes and updates - All you need to know about road restrictions and rules driving law updates and more. In many cases a provisional interest certificate can also be obtained at the beginning of the financial. A source code is a four digit identifier number that SARS uses to capture information on the income tax return.

If during the evaluation described in Ohio AdmCode 37966-2-04B an application or Applicant is found to be ineligible for licensure the Board will proceed to review the next. There are limitations on a provisional license that are not only legally enforced but part of driver safety. For the period which is already completed.

Provisional tax and rules on use of money interest. 2575 Part-time Provisional Certificates Repealed 2580 Endorsement for Part-time Provisional Career and Technical Educator. 2572 Endorsement for Provisional Career and Technical Educator.

6 Employment records including records of unemployment compensation. 2582 Requirements for the Early Childhood Certificate 2004 Repealed ISBE 23 ILLINOIS ADMINISTRATIVE. With this Rule 364 of the CGST Rules loses its purpose while the new clause aa under Section 162 comes into force.

Qualifying provisional taxpayers may pay 15 instead of one half of an amount equal to the total. What is the use of Provisional Receipt Number. Provisional Balance Sheet.

Before the official 2022 Texas income tax rates are released provisional 2022 tax rates are based on Texas 2021 income tax brackets. Get your first provisional driving licence for a car motorbike moped or other vehicle from DVLA online. The Provisional Receipt is issued along with a 15 digit number known as the Provisional Receipt Number.

For example if the suppliers uploaded invoices having eligible ITC worth Rs85000 in the GSTR-2B and the total. View All Options iMOBILE PAY. Make online payment of direct tax and other taxes such as service tax or excise duty.

Use Scan to Pay to generate QR code scan using any UPI app and make the payment. Make your GST payments through our branch or with. Suppose our balance sheet as on 31 st March 2020 which is not yet finalized but our banks or other institutions ask for balance sheet then we provide them a Provisional balance sheet.

Definition and Examples of Provisional Income. The ranked order lists shall be used to award provisional dispensary licenses subject to Ohio AdmCode 37966-2-04B until all available provisional dispensary licenses for that district are awarded. About half of all Americans have sufficient provisional income to have to pay tax on at least some of their benefits according to the Congressional Research Service.

Be at least 15 years and 9 months old. Youll have to pay provisional tax if you had to pay more than 5000 tax at the end of the year from your last return. Pin Code 0 6 Digits.

If you have a provisional license you are probably a newer driver and eager for the freedom a vehicle provides. No one can assure you have sufficient practice hours but a provisional license gives you an opportunity to. There is some technical issue.

But what is a provisional license exactly. Use NFC-enabled tag linked with prepaid account to tap and pay at merchant outlets. The 2022 state personal income tax brackets are updated from the Texas and Tax Foundation data.

Make online payment of direct tax and other taxes such as service tax or excise duty. Provisional Receipt Number is very important and is used for various reasons. From 1st January 2022 onwards businesses must claim Input Tax Credit ITC that only appears in GSTR-2B.

This rule has been in place since 1984 although its not precisely defined in the Internal Revenue Code IRC. It will usually appear alongside the amount it relates to. Source codes that might appear on your.

Provisional tax helps you manage your income tax. Meaning of unpaid tax and overpaid tax for provisional tax purposes. Underestimation or underpayment of taxable income on a Provisional Tax Return may lead to penalties and interest.

Texas tax forms are sourced from the Texas income tax forms page and are updated on a yearly basis. 5 A completed and signed Federal State or local income tax return with the applicants name and address preprinted on it. MAR 28 AIM instalments are due if you file GST monthly and have a March balance date.

Where provisional tax paid by company does not count as overpaid. 2500 before the 2020 return. 16 indicates an increase to the tax rate of 10 per 100000 from the previous year which would bring the.

The provisional ITC availed in a tax period was limited to ensure that the total ITC availed does not exceed the total eligible ITC. Enter a valid Full Name.

Part 3 Income Tax And Provisional Tax

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Pin By Complypartner On Business Developed Economy Start Up Digital Marketing Services

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Enrolment Of Central Excise Service Tax Vat Tot Entry Tax Luxury Tax Entertainment Tax Dealers On The Gst System Port System Goods And Service Tax Portal

Do I Need To Complete A Provisional Tax Return Sa Institute Of Taxation